This includes assessing internal cash reserves, borrowing capacity, and potential access to external funding sources. Continuous technological evolution requires organizations to consider 5 ways to reduce your taxes for next year future upgrade requirements and innovation needs. This includes evaluating flexibility for future modifications and potential costs of staying technologically competitive.

Communicates project benefits to stakeholders

- Other than direct purchases, most capital projects will incorporate an amount of both Capital Expenditure (CapEx) and Operational Expenditure (OpEx).

- Monitoring these figures and comparing them to actual results can give a firm an accurate picture of its financial performance.

- These user-friendly designs simplify navigation, provide intuitive workflows, and offer customizable views while maintaining robust functionality for advanced users and detailed analysis requirements.

- Detailed analysis of direct and indirect costs, including labor, materials, utilities, and maintenance expenses, is crucial for accurate operating cost projections.

When stakeholders feel their input is valued and incorporated into decision-making, they are more likely to support implementation efforts and actively contribute to project success. This metric evaluates how effectively invested capital is being used to generate returns. Organizations should track completion percentages, identify causes of delays, and assess impacts on project returns while maintaining clear documentation of progress and implementing corrective actions when necessary. Establish systematic processes for conducting post-implementation evaluations of completed projects. Research and maintain relationships with various funding sources including banks, investors, and strategic partners.

Aligns investments with strategic goals

Other than direct purchases, most capital projects will incorporate an amount of both Capital Expenditure (CapEx) and Operational Expenditure (OpEx). This split between CapEx and OpEx should be retained throughout the project budgeting and execution lifecycle. An effective financial analysis should not simply assume that all costs are incurred at the beginning, but should rather model the work breakdown and interdependency between activities.

Operating Income: Understanding its Significance in Business Finance

Additionally, capital budgeting plays a critical role in measuring fiscal performance. The point of initiation for any project is invariably a capital budget that outlines the project's anticipated revenues and expenses. Monitoring these figures and comparing them to actual results can give a firm an accurate picture of its financial performance. Disparities between expected and actual figures may also prompt a revision of strategies or identification of areas needing improvement.

Engages stakeholders in recognizing risks

However, if liquidity is a vital consideration, then payback periods are of major importance. Instead of strictly analyzing dollars and returns, payback methods of capital budgeting plan around the timing of when certain benchmarks are achieved. For some companies, they want to track when the company breaks even (or has paid for itself). For others, they’re more interested in the timing of when a capital endeavor earns a certain amount of profit.

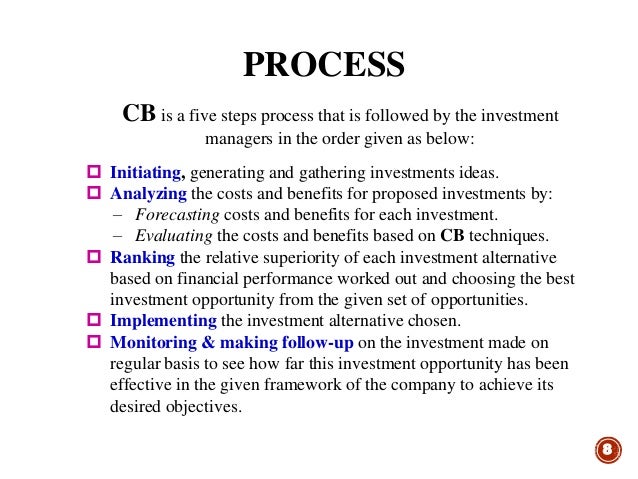

Process of capital budgeting in financial management

In a globalized economy, geopolitical risks have become a crucial factor in capital budgeting decisions. Political instability can heavily impact project feasibility and profitability, especially in volatile regions. Therefore, geopolitical factors should be incorporated in the risk analysis when deciding about an investment in a foreign country. Capital budgeting is the process organizations use to evaluate whether or not to fund major projects or investments intended to increase cash flow or advance strategic objectives.

Throughput analysis is the most complicated method of capital budgeting analysis, but it's also the most accurate in helping managers decide which projects to pursue. Under this method, the entire company is considered as a single profit-generating system. Payback analysis calculates how long it will take to recoup the costs of an investment. The payback period is identified by dividing the initial investment in the project by the average yearly cash inflow that the project will generate. With present value, the future cash flows are discounted by the risk-free rate because the project needs to earn that amount at least; otherwise, it wouldn't be worth pursuing. For each specific technique, companies have a predetermined set of criteria against which they compare the project’s expected results to make their acceptance or rejection decision.

It is a challenging task for management to make a judicious decision regarding capital expenditure (i.e., investment in fixed assets). For this reason, capital expenditure decisions must be anticipated in advance and integrated into the master budget. Estimate operating and implementation costsThe next step involves estimating how much it will cost to bring the project to fruition. The company should then attempt to further narrow down the cost of implementing whichever option it chooses.

ImplementIf a company chooses to move forward with a project, it will need an implementation plan. The plan should include a means of paying for the project at hand, a method for tracking costs, and a process for recording cash flows or benefits the project generates. The implementation plan should also include a timeline with key project milestones, including an end date if applicable.

As opposed to an operational budget that tracks revenue and expenses, a capital budget must be prepared to analyze whether or not the long-term endeavor will be profitable. Capital budgets are often scrutinized using NPV, IRR, and payback periods to make sure the return meets management’s expectations. The profitability index (PI) is calculated by dividing the present value of future cash flows by the initial investment. A PI greater than 1 indicates that the NPV is positive, while a PI of less than 1 indicates a negative NPV. Weighted average cost of capital (WACC) may be hard to calculate, but it’s a solid way to measure investment quality.