Deskera Books can be especially useful in improving cash flow and budgeting for your business. Once the project is implemented, now come the other critical elements such as completing it in the stipulated time frame or tax day trivia reduction of costs. Hereafter, the management takes charge of monitoring the impact of implementing the project. Since there is no ‘one-size-fits-all’ factor, there is no defined technique for selecting a project.

What is Capital Budgeting? Process, Methods, Formula, Examples

Such measures help to expedite and ensure the effectiveness of project prioritization. Not only is this a direct cost to the organization, but the key risk is that so much time is spent administering the process, that insufficient time is invested in ideation or in deeper evaluation of initiatives. The consequence of all this wasted administrative effort is that better initiatives are not identified, and returns are diminished. Internal Rate of Return refers to the discount rate that makes the present value of expected after-tax cash inflows equal to the initial cost of the project. Capital budgets helps to determine the type and quantity of projects a company invests in.

Launching new products

The payback period method of capital budgeting holds a lot of relevance, especially for small businesses. It is a simple method that only requires the business to repay in the predecided timeframe. However, the problem it poses is that it does not count in the time value of money. This is to say that equal amounts (of money) have different values at different points in time.

Net Present Value or Internal Rate of Return

As a result, payback analysis is not considered a true measure of how profitable a project is but instead provides a rough estimate of how quickly an initial investment can be recouped. If more than one projects have been approved and listed in the company’s capital budget, the implementation follows a preference ranking, as discussed in step 4 above. Individual managers serving at various levels of organization can approve only those projects that fall within their authorized limit of investment. Generally, the higher the level of a manager, the larger the size of project he can approve.

- It is a simple technique that determines if an enhanced value of a project justifies the required investment.

- Whatever capital budgeting decisions one makes, project management software can help track those costs.

- Review all proposed projects against established criteria to create a focused list of viable opportunities.

- A more effective capital budgeting software solution combines project planning and delivery management with financial analysis and forecasting.

How to Run a Successful Electrical Business

These are investments of significant value, such as the purchase of a new facility, fixed assets or real estate. While the shorter duration forecasts may be estimated, the longer ones are bound to be miscalculated. Therefore, an expanded time horizon could be a potential problem while computing figures with capital budgeting. It refers to the time taken by a proposed project to generate enough income to cover the initial investment. In smaller businesses, a project that has the potential to deliver rapid and sizable cash flow may have to be rejected because the investment required would exceed the company's capabilities.

Implementation of project

Plus, all reports can be filtered to show only what you want to see and then shared with stakeholders to keep them updated. The profitability index calculates the cash return per dollar invested in a capital project. This is done by dividing the net present value of all cash inflows by the net present value of all the outflows. Throughput analysis looks at the entire company as a sign profit-generating system, with the throughput being the measured amount of materials going through the system.

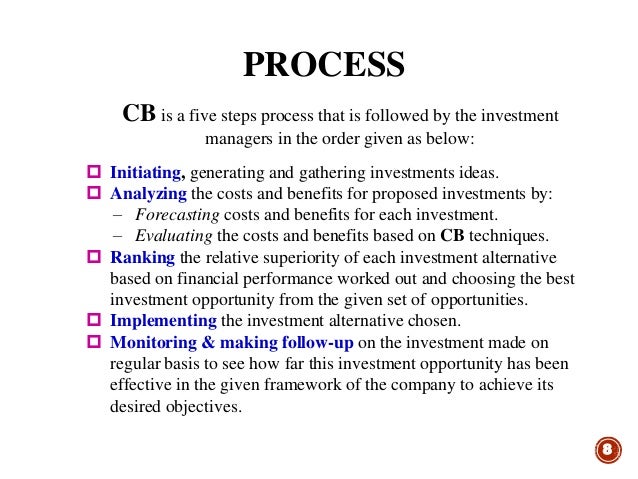

Companies use different metrics to track the performance of a potential project, and there are various methods to capital budgeting. This guide will cover the importance of capital budgeting, how the process looks, and common techniques you can use to reach an investment decision. Capital budgeting is important as it provides businesses with a way to evaluate and measure a project’s value against what they have to invest in that project. This way, managers can assess and rank those projects or investments, which is critical as these are large capital investments that can make or break a company.

Every business has diverse requirements and therefore, the approval over a project comes based on the objectives of the organization. As per the rule of the method, the profitability index is positive for the 10% discount rate, and therefore, it will be selected. It follows the rule that if the IRR is more than the average cost of the capital, then the company accepts the project, or else it rejects the project. If the company faces a situation with multiple projects, then the project offering the highest IRR is selected by them. Project managers can use the DCF model to decide which of several competing projects is likely to be more profitable and worth pursuing. However, project managers must also consider any risks involved in pursuing one project versus another.