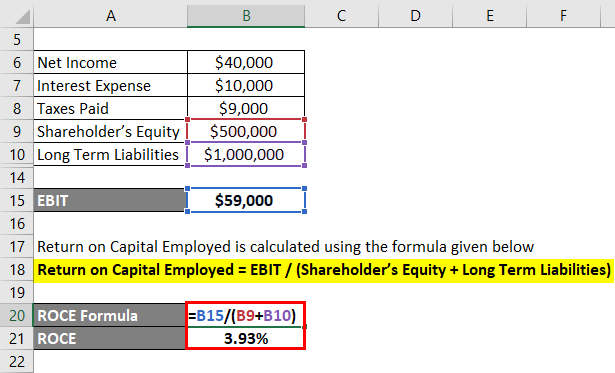

ACE's ROCE is 44 cents per capital dollar or 43.51% versus 15 cents per capital dollar for Sam & Co., or 15.47%. It is a reflection of previous capital investments' success and may not be a reliable predictor of future profitability or the potential effects of new investments. In addition, the effect of a company's collector greene county capital structure, such as debt or equity financing, is not taken into account by ROCE. Also known as operating income, EBIT shows how much a company earns from its operations alone without interest on debt or taxes. It is calculated by subtracting the cost of goods sold (COGS) and operating expenses from revenues.

To Ensure One Vote Per Person, Please Include the Following Info

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The higher the ratio, the more efficient the company has been in using funds entrusted to it. ROE can be used to evaluate virtually any company, while ROCE should be restricted to analyzing non-finance companies.

Best Business Loans for Bad Credit: The Essential Guide

It is essential for assessing a company's financial structure, efficiency, and its ability to generate returns for its investors. Looking at the fixed asset method, one could deduce that a company is essentially including all assets. For a simplified formula, some companies may calculate capital deployed as total assets less current liabilities. This can be assumed if the company does not have many assets outside of current assets and fixed assets.

Is Capital Employed the same as equity?

The capital allocation gives an idea about how much fund is available for investment that will generate enough return for it to become profitable and sustainable in future. Investors who put their money into a business tend to keep track of its performance and expect a return on the funds. It essentially means that for every dollar invested in the business, the business earns a return of $3.85. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. We are going to analyze a company that has returned 191% in capital gains in the last 12 months (see capital gains yield calculator).

These formulas help determine the amount of capital invested in a business to generate profits and sustain operations. By understanding the components of capital employed, companies can assess their financial health and make informed decisions regarding investments and growth strategies. Capital employed analysis offers a comprehensive view of a company’s financial efficiency by considering debt and equity. Investors can use this metric to compare the return on capital employed (ROCE) to the cost of capital, determining if the company generates adequate returns.

First, we need to determine XYZ Corp’s total assets, which include cash, inventory, equipment, and any other company-owned resources. The capital ratio can also be used to compare capital against capital employed. It works best when paired with other ratios or when compared to industry averages.

Hopefully, this article helps you better understand ROCE and what it means. On the balance sheet, if we assume our capital employed grew from $50,000 to $70,000, we can assume that the return on capital employed is 40%. EBIT is also known as operating income, divided by the figure for employed capital to get ROCE. It is especially useful in comparing capital utilization in companies operating in capital-intensive industries.

- All definitions generally refer to the capital investment necessary for a business to function.

- However, limitations exist, such as not accounting for cash flow timing and challenges in comparing ROCE across different industries due to varying capital intensity levels.

- This determines how capital employed compares to capital going into a company.

- The long-term profitability value that ROCE provides is a major reason why many stakeholders use it to measure the long-term growth and performance of the company.

Analysts use capital employed to calculate return on capital employed (ROCE). A higher ROCE indicates a more efficient company with more successful capital investments. In general, the higher the return on capital employed (ROCE), the better it is for a company. The ROCE calculation shows how much profit a company generates for each dollar of capital employed.

For ROCE, capital employed captures the total amount of debt financing and equity available to fund operations and purchase assets. An acceptable return on capital employed is only good when it is above its weighted average cost of capital (WACC). This is because the WACC represents the cost of acquiring debt and equity. We specifically consider interest-bearing debt, and we only account for long-term debt because we are talking about long-term financing.

Of course, you can get the data and input it into our great return on the capital employed calculator to get the result even faster. For a more precise income generated by operations that are not affected by non-cash expenses, please consider EBITDA. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.